There are affiliate links on this page.

Read our disclosure policy to learn more.

Translate this page to any language by choosing a language in the box below.

Fake Bills - Pro Forma Invoicing: International Directories Corporation

Fake Bills - Pro Forma Invoicing:

International Directories Corporation

Have your received a fax, email or letter from International Directories Corporation

What is pro forma invoicing?

This is a bill your receive for goods or services that you never requested. The scam typically involves sales people from a publishing company contacting a business and falsely claiming that the business agreed to advertise in a particular publication. This is also called "false invoicing" or "false billing". The scam primarily targets small businesses. It is a breach of the law to engage in pro forma invoicing. Also see our page on "Deceptive Ads and Mock bills: sales materials that look like invoices".

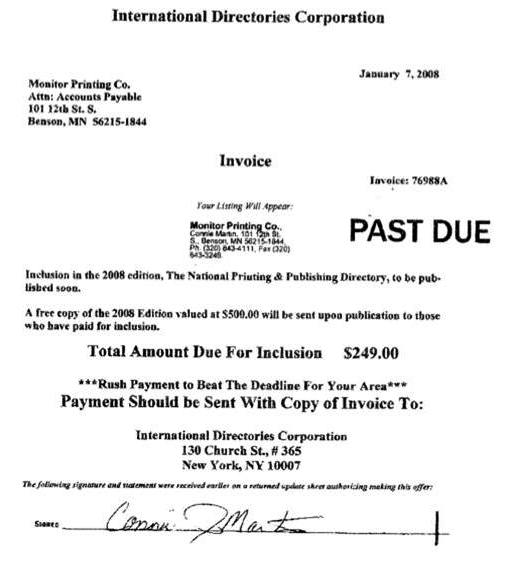

Example: International Directories Corporation

We first saw it in February 2007 and they're at it again in 2008. The invoice

has the company president's forged signature at the bottom of the invoice.

It is not his actual signature but is pretty close. Just above the signature

it says: "The following signature and statement were received earlier on a

returned update sheet authorizing making this offer." The payment address

listed is:

International Directories Corporation

130 Church St., #365

New York, NY 10007

Amount of the invoice is $249.00.

Here is an example - we've blotted out the victim's information.:

Reports from visitors:

Received March 13, 2008:

International Directories Corporation past due bill .....this is fraud we have never used this company and the fax we recieve (about 2 per day). there is no contact information for this company other then where to send payment...

International Directories Corporation

130 Church St # 365

New York, NY 10007

Below is a judgment from the FCC against the company and people behind the International Directories Corporation pro form invoicing scam. You can find the original source on the FCC website.

Before the

Federal Communications Commission

Washington, D.C. 20554

)

)

)

In the Matter of

) File No. EB-05-TC-052

NATIONAL BUSINESS INFORMATION

CORPORATION ) NAL/Acct. No. 200632170008

Apparent Liability for Forfeiture ) FRN: 0015522121

)

)

)

NOTICE OF APPARENT LIABILITY FOR FORFEITURE

Adopted: September 19, 2006 Released: September 20, 2006

By the Commission:

I. INTRODUCTION

1. In this Notice of Apparent Liability for Forfeiture ("NAL"), we find

that National Business Information Corporation ("NBIC") apparently

willfully or repeatedly violated section 227 of the Communications Act

of 1934, as amended ("Act"), and the Commission's related rules and

orders by delivering at least 34 unsolicited advertisements to the

telephone facsimile machines of at least 8 consumers. Based on the

facts and circumstances surrounding these apparent violations, we find

that NBIC is apparently liable for a forfeiture in the amount of

$153,000.

II. BACKGROUND

2. On August 31, 2005, in response to consumer complaints alleging that

NBIC had faxed unsolicited advertisements, the Commission staff issued

a citation to NBIC, pursuant to section 503(b)(5) of the Act. The

staff cited NBIC for using a telephone facsimile machine, computer, or

other device, to send unsolicited advertisements to a telephone

facsimile machine, in violation of section 227 of the Act and the

Commission's related rules and orders. According to the complaints,

the unsolicited advertisements offered listings in a business

directory. The citation, which the staff served by facsimile and by

certified mail, return receipt requested, warned NBIC that subsequent

violations could result in the imposition of monetary forfeitures of

up to $11,000 per violation, and included a copy of the consumer

complaints that formed the basis of the citation. The citation

informed NBIC that within 21 days of the date of the citation, it

could either request a personal interview at the nearest Commission

office, or could provide a written statement responding to the

citation. NBIC did not request an interview or otherwise respond to

the citation.

3. Despite the citation's warning that subsequent violations could result

in the imposition of monetary forfeitures, we have received additional

consumer complaints indicating that NBIC continued to engage in such

conduct after receiving the citation. We base our action here

specifically on sworn declarations from 8 consumers establishing that

NBIC continued to send 34 unsolicited advertisements to telephone

facsimile machines after the date of the citation.

4. Section 227(b)(1)(C) of the Act makes it "unlawful for any person

within the United States, or any person outside the United States if

the recipient is within the United States . . . to use any telephone

facsimile machine, computer, or other device to send, to a telephone

facsimile machine, an unsolicited advertisement." The term

"unsolicited advertisement" is defined in the Act and the Commission's

rules as "any material advertising the commercial availability or

quality of any property, goods, or services which is transmitted to

any person without that person's prior express invitation or

permission." Under Commission rules and orders in effect at the time

of the alleged violations discussed in this NAL, the Commission viewed

an established business relationship between a fax sender and

recipient as constituting prior express invitation or permission to

send a facsimile advertisement.

5. Section 503(b) of the Act authorizes the Commission to assess a

forfeiture of up to $11,000 for each violation of the Act or of any

rule, regulation, or order issued by the Commission under the Act by a

non-common carrier or other entity not specifically designated in

section 503 of the Act. In exercising such authority, we are to take

into account "the nature, circumstances, extent, and gravity of the

violation and, with respect to the violator, the degree of

culpability, any history of prior offenses, ability to pay, and such

other matters as justice may require."

III. DISCUSSION

A. Violations of the Commission's Rules Restricting Unsolicited Facsimile

Advertisements

6. We find that NBIC apparently violated section 227 of the Act and the

Commission's related rules and orders by using a telephone facsimile

machine, computer, or other device to send at least 34 unsolicited

advertisements to the 8 consumers identified in the Appendix. This NAL

is based on evidence that these 8 consumers received unsolicited fax

advertisements from NBIC after the Bureau's citation. Each of those

facsimile transmissions advertises a business directory, as well as an

offer to be listed in that directory. NBIC has apparently been sending

the faxes from the Minnesota and Florida locations where Commission

staff sent the citation, using both the NBIC name as well as the name

"International Directories Corporation." In addition, NBIC has

recently been listing a Canadian address on some of its facsimile

advertisements.

7. One example of NBIC's facsimile advertisements begins with the

statement "RETURN THIS PAGE FOR YOUR FREE COPY OF THE NATIONAL

CONTRACTORS GUIDE." The facsimile also provides a sample of how a

recipient's listing would appear in the directory, and directs the

recipient to fill out contact information, sign, and return the

facsimile to NBIC for a "free" copy of the latest directory. In fine

print, below the signature line, the fax includes the following

language: "I am enclosing a payment of $189.00 to cover the cost of

inclusion in the 2006 edition. If payment is not enclosed when

submitting this information, my company agrees to pay $199.00 to cover

the cost of inclusion if the company is to be billed." Another example

of the facsimile advertisements is in the form of an invoice. Sent

under the name of IDC, this facsimile also shows the listing of the

fax recipient's company as it will appear in the NBIC business

directory, and states "Inclusion in the 2006 edition, The National

Contractors Guide, to be published soon. A free copy . . . will be

sent upon publication to those who have paid for inclusion. Total

Amount Due For Inclusion $199. ***Rush Payment to Beat The Deadline

For Your Area." The facsimile is stamped "PAST DUE," and includes an

invoice number and a signature block where the complainant allegedly

signed previously to receive a copy of NBIC's directory. None of the

complainants, however, ordered either a business directory or a

listing in that directory. These facsimiles, which are representative

of the others on which this NAL is based, fall within the definition

of an "unsolicited advertisement" in effect at the time of the alleged

violations.

8. Further, according to their declarations, the consumers neither had an

established business relationship with NBIC nor gave NBIC permission

to send the facsimile transmissions. Therefore, NBIC appears to have

sent each facsimile transmission without the prior express consent of

the consumers. NBIC did not respond to the Commission's citation and

thus has offered no evidence or arguments to defend or justify its

faxing practices. Based on the entire record, including the consumer

declarations, we conclude that NBIC apparently violated section 227 of

the Act and the Commission's related rules and orders by sending 34

unsolicited advertisements to 8 consumers' facsimile machines.

B. Proposed Forfeiture

9. We find that NBIC is apparently liable for a forfeiture in the amount

of $153,000. Although the Commission's Forfeiture Policy Statement

does not establish a base forfeiture amount for violating the

prohibition against using a telephone facsimile machine to send

unsolicited advertisements, the Commission has previously considered

$4,500 per unsolicited fax advertisement to be an appropriate base

amount. We apply that base amount to each of 34 of the apparent

violations, for a total proposed forfeiture of $153,000. NBIC shall

have the opportunity to submit evidence and arguments in response to

this NAL to show that no forfeiture should be imposed or that some

lesser amount should be assessed.

IV. CONCLUSION AND ORDERING CLAUSES

10. We have determined that National Business Information Corporation

apparently violated section 227 of the Act and the Commission's

related rules and orders by using a telephone facsimile machine,

computer, or other device to send at least 34 unsolicited

advertisements to the 8 consumers identified in the Appendix. We have

further determined that National Business Information Corporation is

apparently liable for a forfeiture in the amount of $153,000.

11. Accordingly, IT IS ORDERED, pursuant to section 503(b) of the Act, and

section 1.80 of the Rules, 47 C.F.R. S 1.80, 47 U.S.C. S 503(b), that

National Business Information Corporation is hereby NOTIFIED of this

APPARENT LIABILITY FOR A FORFEITURE in the amount of $153,000 for

willful or repeated violations of section 227(b)(1)(C) of the

Communications Act, 47 U.S.C. S 227(b)(1)(C), sections 64.1200(a)(3)

of the Commission's rules, 47 C.F.R. S 64.1200(a)(3), and the related

orders described in the paragraphs above.

12. IT IS FURTHER ORDERED THAT, pursuant to section 1.80 of the

Commission's rules, within thirty (30) days of the release date of

this Notice of Apparent Liability for Forfeiture, National Business

Information Corporation SHALL PAY the full amount of the proposed

forfeiture or SHALL FILE a written statement seeking reduction or

cancellation of the proposed forfeiture.

13. Payment by check or money order, payable to the order of the "Federal

Communications Commission," may be mailed to Forfeiture Collection

Section, Finance Branch, Federal Communications Commission, P.O. Box

358340, Pittsburgh, PA 15251. Payment by overnight mail may be sent to

Mellon Client Service Center, 500 Ross Street, Room 670, Pittsburgh,

PA 15262-0001, Attn: FCC Module Supervisor. Payment by wire transfer

may be made to: ABA Number 043000261, receiving bank Mellon Bank, and

account number 911-6229. The payment should note NAL/Acct. No.

200632170008.

14. The response, if any, must be mailed both to the Office of the

Secretary, Federal Communications Commission, 445 12^th Street, SW,

Washington, DC 20554, ATTN: Enforcement Bureau - Telecommunications

Consumers Division, and to Colleen Heitkamp, Chief, Telecommunications

Consumers Division, Enforcement Bureau, Federal Communications

Commission, 445 12^th Street, SW, Washington, DC 20554, and must

include the NAL/Acct. No. referenced in the caption.

15. The Commission will not consider reducing or canceling a forfeiture in

response to a claim of inability to pay unless the petitioner submits:

(1) federal tax returns for the most recent three-year period; (2)

financial statements prepared according to generally accepted

accounting practices; or (3) some other reliable and objective

documentation that accurately reflects the petitioner's current

financial status. Any claim of inability to pay must specifically

identify the basis for the claim by reference to the financial

documentation submitted.

16. Requests for payment of the full amount of this Notice of Apparent

Liability for Forfeiture under an installment plan should be sent to:

Chief, Revenue and Receivables Operations Group, 445 12th Street, SW,

Washington, DC 20554.

17. IT IS FURTHER ORDERED that a copy of this Notice of Apparent Liability

for Forfeiture shall be sent by Certified Mail Return Receipt

Requested to National Business Information Corporation, Attention:

Richard J. McHenry, Sr., CEO, 1346 W. Arrowhead Rd., #302, Duluth, MN

55811; and to National Business Information Corporation aka Business

Information Corporation, Attention: Don Murray, 6924 Aloma Ave.,

Winter Park, FL 32792.

FEDERAL COMMUNICATIONS COMMISSION

Marlene H. Dortch

Secretary

APPENDIX

Complainant Violation Date(s)

Ed Schmidt, Schmidt Brothers 11/29/05, 1/2/06

Custom Homes, Inc.

Gary Friedman, Cosmopolitan 9/20/05 to 9/25/05 (5 faxes)

Trading

Gene A. Taylor, Dorthy's 6/29/06

Surrender

Jane E. Updegraff, Gem City 12/3/05, 1/19/06

Metal

Kent W. Burkhart, Burkhart 11/25/05

Enterprises

Kristi Guttuso, Hudson Bay 1/26/06, 2/1/06, 2/2/06, 2/3/06,

Development Co., Inc. 2/5/06, 2/12/06, 2/16/06, 2/19/06,

2/26/06, 3/28/06

11/05 (2 faxes), 12/2005 (2 faxes),

Les Ellsworth, Potpourri House 3/9/06, 3/16/06, 3/20/06, 3/23/06,

3/27/06, 3/29/06, 5/4/06 5/12/06

Raul Garcia, True Champions, 2/23/06

Inc.

See 47 U.S.C. S 503(b)(1). The Commission has the authority under this

section of the Act to assess a forfeiture against any person who has

"willfully or repeatedly failed to comply with any of the provisions of

this Act or of any rule, regulation, or order issued by the Commission

under this Act ...." See also [1]47 U.S.C. S 503(b)(5) (stating that the

Commission has the authority under this section of the Act to assess a

forfeiture penalty against any person who is not a common carrier so long

as such person (A) is first issued a citation of the violation charged;

(B) is given a reasonable opportunity for a personal interview with an

official of the Commission, at the field office of the Commission nearest

to the person's place of residence; and (C) subsequently engages in

conduct of the type described in the citation).

According to publicly available information, NBIC is headquartered at 1346

W. Arrowhead Rd., #302, Duluth, MN 55811; an alternate address, under the

name International Directories Corporation ("IDC"), is 6924 Aloma Ave.,

Winter Park, FL 32792. See text accompanying n.14, infra. Therefore, all

references in this NAL to "NBIC" encompass National Business Information

Corporation as well as International Directories Corporation. NBIC's

registered agent is Richard J. McHenry, Sr., who is also listed as the

Chief Executive Officer. Don Murray is listed as the contact person for

NBIC's Florida address. Accordingly, all references in this NAL to "NBIC"

also encompass Richard J. McHenry, Sr., Don Murray, and all other

principals and officers of these entities, as well as the corporate

entities themselves.

See [2]47 U.S.C. S [3]227(b)(1)(C); [4]47 C.F.R. S 64.1200(a)(3); see

also Rules and Regulations Implementing the Telephone Consumer Protection

Act of 1991, Report and Order, 18 FCC Rcd 14014, 14124, para. 185 (2003)

(TCPA Report and Order) (stating that section 227 of the Act prohibits the

use of telephone facsimile machines to send unsolicited advertisements).

Citation from Kurt A. Schroeder, Deputy Chief, Telecommunications

Consumers Division, Enforcement Bureau, File No. EB-05-TC-052, issued to

NBIC on August 31, 2005.

See 47 U.S.C. S 503(b)(5) (authorizing the Commission to issue citations

to non-common carriers for violations of the Act or of the Commission's

rules and orders).

See, e.g., Complaint letter from Jill Gilbert, AHA Services, Inc., dated

August 26, 2005, which was attached to the citation (stating that her

company regularly receives multiple unwanted fax advertisements from NBIC,

even though she has requested that NBIC stop sending the faxes, and her

company has had no prior business association with NBIC).

Commission staff mailed the citation to NBIC's Minnesota and Florida

addresses. See n.2, supra. Although the U.S. Postal Service returned to

the Commission as "unclaimed" the copy of the citation sent to NBIC's

Florida address, NBIC signed the return receipt for the citation sent to

its Minnesota address.

See Appendix for a listing of the consumer declarations from complainants

requesting Commission action.

We note that evidence of additional instances of unlawful conduct by NBIC

may form the basis of subsequent enforcement action.

47 U.S.C. S 227(b)(1)(C).

Rules and Regulations Implementing the Telephone Consumer Protection Act

of 1991, Memorandum Opinion and Order, 10 FCC Rcd 12391, 12408, para. 37

(1995) (1995 TCPA Reconsideration Order); see also Rules and Regulations

Implementing the Telephone Consumer Protection Act of 1991, Order, 20 FCC

Rcd 11424 (2005). Under the Junk Fax Prevention Act of 2005, Pub. L.

109-21, 119 Stat. 359 (2005), Congress amended the Communications Act to

specify, among other things, the conditions under which an established

business relationship provides an exception to the prohibition on

unsolicited fax advertising. The Commission recently released rules to

implement the Junk Fax Prevention Act, including rules that determined

specific time parameters for the established business relationship

exception. See Rules and Regulations Implementing the Telephone Consumer

Protection Act of 1991, Report and Order and Third Order on

Reconsideration, 21 FCC Rcd 3787 (2006). These revised rules were not in

effect at the time of the alleged violations in this case, although the

Commission's original established business relationship exception was in

effect, as noted above.

Section 503(b)(2)(C) provides for forfeitures up to $10,000 for each

violation in cases not covered by subparagraph (A) or (B), which address

forfeitures for violations by licensees and common carriers, among others.

See 47 U.S.C. S 503(b). In accordance with the inflation adjustment

requirements contained in the Debt Collection Improvement Act of 1996,

Pub. L. 104-134, Sec. 31001, 110 Stat. 1321, the Commission implemented an

increase of the maximum statutory forfeiture under section 503(b)(2)(C) to

$11,000. See 47 C.F.R. S1.80(b)(3); Amendment of Section 1.80 of the

Commission's Rules and Adjustment of Forfeiture Maxima to Reflect

Inflation, 15 FCC Rcd 18221 (2000); see also Amendment of Section 1.80(b)

of the Commission's Rules and Adjustment of Forfeiture Maxima to Reflect

Inflation, 19 FCC Rcd 10945 (2004) (this recent amendment of section

1.80(b) to reflect inflation left the forfeiture maximum for this type of

violator at $11,000).

47 U.S.C. S 503(b)(2)(D); The Commission's Forfeiture Policy Statement and

Amendment of Section 1.80 of the Rules to Incorporate the Forfeiture

Guidelines, Report and Order, 12 FCC Rcd 17087, 17100-01 para. 27 (1997)

(Forfeiture Policy Statement), recon. denied, 15 FCC Rcd 303 (1999).

See n.2, supra.

See, e.g., declaration dated June 21, 2006, from Jane E. Updegraff, Gem

City Metal, facsimile attachments.

Declaration dated August 8, 2006, from Kristi Guttuso, Hudson Bay

Development Co., Inc, facsimile attachments. A copy of one of these

facsimiles is attached in the Appendix as an example. We have redacted

certain identifying information of the complainant.

Declaration dated June 22, 2006, from Raul Garcia, True Champions, Inc.,

facsimile attachment. A copy of this facsimile is attached in the Appendix

as an example. We have redacted certain identifying information of the

complainant, including the apparently falsified signature.

See, e.g., Declaration dated June 22, 2006, from Raul Garcia, True

Champions, Inc. (stating that to the best of his knowledge, at no time did

anyone in his household engage in any business transaction with IDC). This

second type of advertisement appears to be designed to fraudulently convey

that the recipient already ordered a business directory. The Commission

staff has referred the possible fraud aspects of this case to the Federal

Trade Commission.

At the time of the alleged violations, the term "unsolicited

advertisement" (then codified at 47 U.S.C. S 227(a)(4) and 47 C.F.R. S

64.1200(f)(10)) meant "any material advertising the commercial

availability or quality of any property, goods, or services which is

transmitted to any person without that person's prior express invitation

or permission." The current definition is codified at 47 U.S.C. S

227(a)(5) and 47 C.F.R. S 64.1200(f)(13).

See, e.g., Declaration dated June 30, 2006, from Les Ellsworth (stating

that, to the best of his knowledge, at no time did anyone in his household

give IDC prior express consent to deliver a facsimile advertisement, nor

did anyone engage in any business transaction with IDC). All of the

complainants involved in this action are listed in the Appendix below.

Mere distribution or publication of a fax number does not establish

consent to receive advertisements by fax. 1995 Reconsideration Order, 10

FCC Rcd at 12408-09, para. 37; see also Rules and Regulations Implementing

the Telephone Consumer Protection Act of 1991, Memorandum Opinion and

Order, 18 FCC Rcd 14014, 14129, para. 193 (2003) (concluding that mere

publication of a fax number in a trade publication or directory does not

demonstrate consent to receive fax advertising).

See Get-Aways, Inc., Notice of Apparent Liability For Forfeiture, 15 FCC

Rcd 1805 (1999); Get-Aways, Inc., Forfeiture Order, 15 FCC Rcd 4843

(2000); see also US Notary, Inc., Notice of Apparent Liability for

Forfeiture, 15 Rcd 16999 (2000); US Notary, Inc., Forfeiture Order, 16 FCC

Rcd 18398 (2001); Tri-Star Marketing, Inc., Notice of Apparent Liability

For Forfeiture, 15 FCC Rcd 11295 (2000); Tri-Star Marketing, Inc.,

Forfeiture Order, 15 FCC Rcd 23198 (2000).

See 47 U.S.C. S 503(b)(4)(C); 47 C.F.R. S 1.80(f)(3).

47 C.F.R. S 1.80.

47 C.F.R. S 1.1914.

Although without the exact dates, Mr. Friedman recalls receiving a total

of 5 faxes between September 20, and September 25, 2005. See Declaration,

dated July 18, 2006, from Gary Friedman.

Although without the exact dates, Mr. Ellsworth recalls receiving 2 faxes

in November, 2005, and 2 faxes in December, 2005. See Declaration, dated

June 30, 2006, from Les Ellsworth.

(...continued from previous page)

(continued....)

Federal Communications Commission FCC 06-140

1

2

Federal Communications Commission FCC 06-140

How to avoid pro forma invoices

- Ask for proof that the advertisement was agreed to - no proof, no payment.

- Verify the booking with colleagues.

- Ask if the publisher has had a circulation audit done by the Circulations Audit Bureau (CAB) or the Audit Bureau of Circulations (ABC). While the absence of an audit does not necessarily mean the publication is not genuine, its presence is positive evidence otherwise.

- Ask for specific evidence that the publishing company has been commissioned by an organization to publish the magazine on their behalf.

- Keep records of telephone conversations discussing advertising, including date, what was discussed and who it was discussed with.

- Have an advertising booking system in place and ensure all staff are aware of it.

- Inform the company in writing that the advertisement they are charging you for was not authorized and will not be paid for.

- Seek legal advice if threatened with legal action.

- In the U.S. file a complaint with the

Federal Trade Commission.

In New Zealand, inform the Commerce Commission.

If you receive an invoice from these companies, we suggest you do not pay.

For a comprehensive list of national and international agencies to report scams, see this page.